How to Take a 401K Loan from Fidelity: A 401(k) loan can be a useful financial tool in times of need, and if you have your retirement plan with Fidelity, the process is relatively straightforward. Many people are unsure how it works, what the risks are, and whether they even qualify. In this detailed guide, we will walk you through everything you need to know about taking a 401(k) loan from Fidelity in 2025.

We’ll explain how the loan process works, what requirements you must meet, the pros and cons, and answer the most frequently asked questions—all in simple, easy-to-understand terms.

How to Take a 401K Loan from Fidelity: Step-by-Step Guide for 2025

How to Take a 401K Loan from Fidelity

What Is a 401(k) Loan?

A 401(k) loan allows you to borrow money from your own retirement savings. It’s not the same as withdrawing funds; you are essentially taking out a loan from your own account, and then paying yourself back over time with interest.

Key Features:

- You can borrow up to 50% of your vested account balance or $50,000, whichever is less.

- Loan repayments (including interest) are deducted from your paycheck.

- No credit check is required.

- You must repay the loan within 5 years (or sooner if it’s for housing).

Who Can Take a 401(k) Loan from Fidelity?

Fidelity serves as the plan administrator for many employers. Not all 401(k) plans allow loans, so the first step is checking whether your employer’s plan permits it.

To qualify for a loan, you must:

- Be currently employed with the company that sponsors the 401(k).

- Have a vested balance large enough to support the loan.

- Meet any employer-specific conditions (some restrict loans).

You can verify your eligibility by logging into your Fidelity NetBenefits account or contacting their customer support.

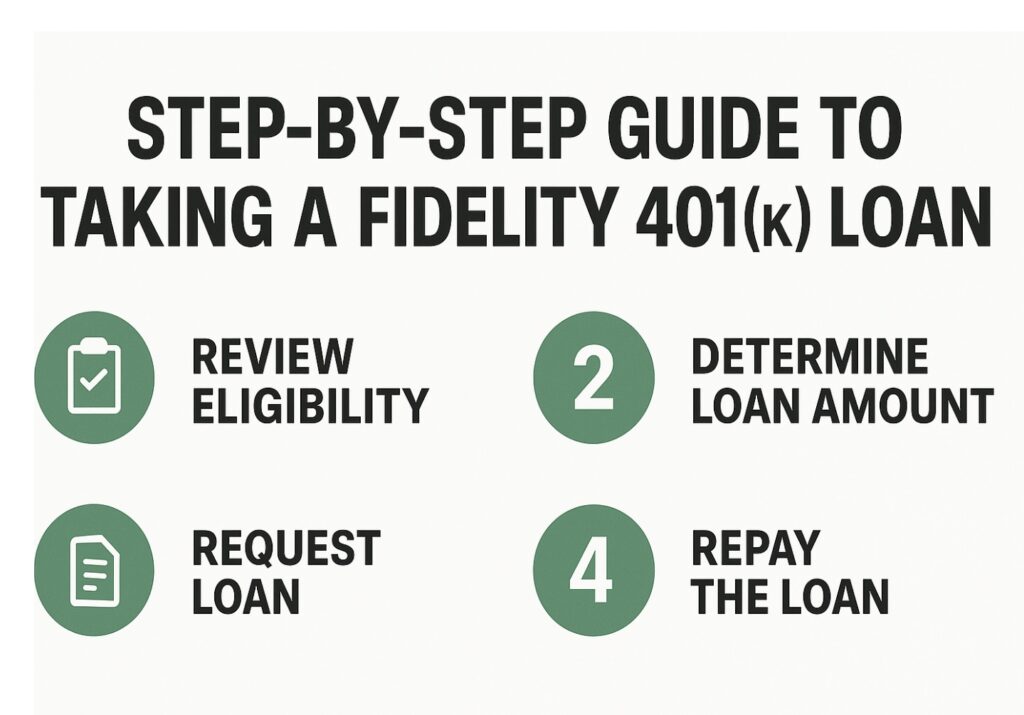

Step-by-Step Guide to Taking a Fidelity 401(k) Loan

Step 1: Log in to Your Fidelity NetBenefits Account

Go to NetBenefits.com and enter your credentials.

Step 2: Navigate to Your 401(k) Plan

Under “Accounts,” select your 401(k) plan.

Step 3: Check Eligibility

Click on “Loans” or “Plan Information” to see if your plan allows loans.

Step 4: Estimate Loan Amount

Use Fidelity’s loan calculator to see how much you can borrow and what your payments will be.

Step 5: Submit the Loan Request

You can apply online. Fidelity will guide you through the required steps, including choosing your loan amount, duration, and payment schedule.

Step 6: Receive the Funds

Once approved, funds are typically deposited into your bank account within a few business days.

Pros and Cons of a 401(k) Loan from Fidelity

Pros:

- No Credit Check: Doesn’t affect your credit score.

- Lower Interest Rates: Often lower than personal loans or credit cards.

- You Pay Yourself Back: Interest goes into your own 401(k) account.

- Quick Access: Funds are usually available within a few days.

Cons:

- Repayment Risk: If you leave your job, the loan is due quickly (typically 60 days).

- Lost Investment Growth: Borrowed money isn’t invested and doesn’t grow.

- Tax Penalty Risk: If not repaid, the loan becomes a taxable distribution.

How to Take a 401K Loan from Fidelity: Step-by-Step Guide for 2025

How Is a Fidelity 401(k) Loan Repaid?

Repayments are automatically deducted from your paycheck based on the schedule you choose. Most loans require:

- Monthly Payments: Principal + interest

- 5-Year Maximum Term: Unless the loan is for buying a primary residence

- Fixed Interest Rate: Typically around the Prime Rate + 1%

You can also repay the loan early with no prepayment penalties.

When Taking a 401(k) Loan Makes Sense

A 401(k) loan may be a smart move if:

- You’re facing a financial emergency.

- You have high-interest debt to pay off.

- You’re purchasing a primary residence.

- You’ve exhausted all other affordable loan options.

Always weigh the pros and cons and consider speaking to a financial advisor.

What Happens If You Leave Your Job?

This is one of the biggest risks. If you leave your job (voluntarily or involuntarily), the remaining loan balance becomes due quickly, usually within 60 days.

Options:

- Repay the Loan within the grace period.

- Rollover the Loan to an IRA (if allowed).

- If you can’t repay, the loan is considered a distribution and you may face income tax and a 10% early withdrawal penalty.

Tips to Use a 401(k) Loan Wisely

- Borrow only what you need.

- Understand your employer’s rules.

- Make consistent payments.

- Avoid borrowing for non-essentials.

Final Thoughts

How to Take a 401K Loan from Fidelity: A 401(k) loan from Fidelity can be a fast, low-interest way to access cash when you need it most—but it’s not a decision to take lightly. While the application process is straightforward and there’s no impact on your credit score, the risks of job loss, lost investment gains, and potential tax penalties make it essential to plan carefully. Always borrow the minimum you need, and ensure you have a solid repayment strategy in place.

If you’re considering this option, speak with a financial advisor to understand how it fits into your overall retirement goals. Used wisely, a 401(k) loan can offer relief in tough times without derailing your future financial security. Your retirement savings are valuable—handle them with care.